Executive Summary (For Busy Readers)

-

Halving does not “kill” miners — it restructures them.

-

The true order of importance for mining ROI is:

Price trend > Electricity cost > Hardware efficiency > Reward schedule -

Strong deflation (Bitcoin) creates high volatility and brutal miner淘汰

-

Moderate emission cuts (ETC) produce smoother cash flow and favor mid-size miners

-

No halving (Dogecoin) turns mining into a pure price speculation game

Halving is not a technical event — it is a supply-side economic shock.

1. What Is Halving? A Supply-Side Shock to Mining

Halving means one thing:

the network suddenly cuts the miner’s “salary” in half.

In Bitcoin’s case:

-

Every ~210,000 blocks (~4 years)

-

Block rewards are cut by 50%

-

New coin issuance instantly drops by 50%

For miners:

Same machines. Same electricity.

Half the base revenue.

This is not subtle — it is one of the most aggressive monetary policies in modern finance.

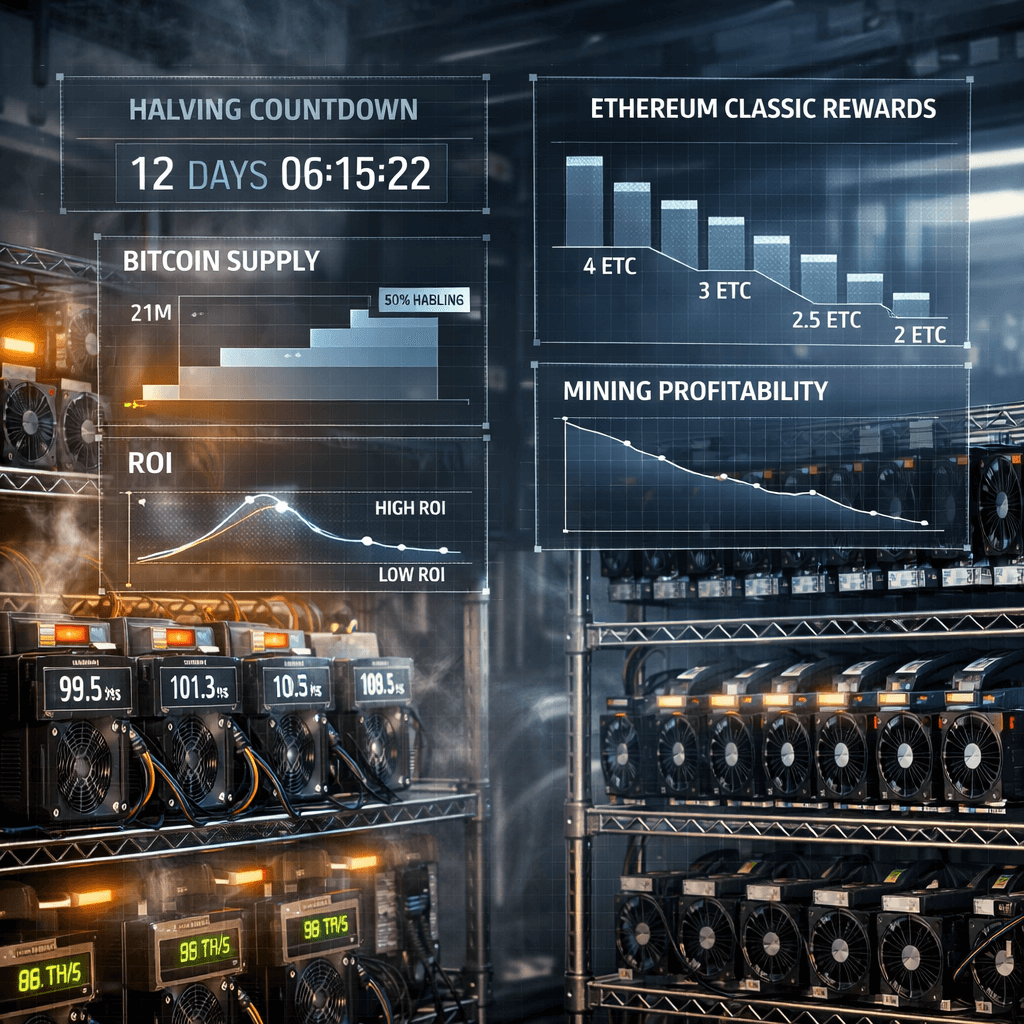

2. What Really Happened After Each Bitcoin Halving?

2012 – The First Halving

Reward: 50 → 25 BTC

Price: ~$12 → ~$1,000 (12 months later)

-

GPU & early miners saw absurd returns

-

ROI measured in weeks

-

This was a once-in-history monetary event

➡️ A mythological profit era that will never repeat

2016 – The Second Halving

Reward: 25 → 12.5 BTC

Price: ~$650 → ~$19,000

-

ASIC mining became mandatory

-

Electricity became the profit killer

-

ROI stretched to 6–12 months

➡️ The birth of industrial-scale mining

2020 – The Third Halving

Reward: 12.5 → 6.25 BTC

Price: ~$9,000 → ~$69,000

-

Old machines were wiped out

-

Profit depended entirely on price going up

-

ROI: 12–18 months

➡️ Halving + bull market = survival

Halving + bear market = death

2024 – The Fourth Halving

Reward: 6.25 → 3.125 BTC

Immediate effects:

-

Hashrate drops

-

High-cost miners shut down

Then:

-

Difficulty falls

-

Remaining miners gain higher share

Realistic ROI Model

| Metric | Before Halving | After Halving |

|---|---|---|

| Daily Revenue | $26 | $13 |

| Electricity | $7 | $7 |

| Daily Profit | $19 | $6 |

| Payback Time | ~9 months | ~27 months |

➡️ Halving does not cause instant losses — it stretches ROI.

3. What Miners Actually Earn From

Most miners think they earn from block rewards.

That is already becoming wrong.

1) Block Rewards

-

Declining forever

-

Goes to zero around 2140

2) Transaction Fees

-

Grow during congestion and bull markets

-

Can reach 20–40% of miner income

➡️ The miner of the future is not a “coin printer”

They are a settlement infrastructure provider.

4. Supply Schedules Change Everything

| Coin | Emission Model | Impact on Miners |

|---|---|---|

| Bitcoin | Halving (-50%) | High volatility, brutal淘汰 |

| Litecoin | Same as BTC | Follows BTC, smaller market |

| Dogecoin | No halving | 100% price-driven |

| Ethereum Classic | -20% reductions | Smooth, miner-friendly |

Bitcoin & Litecoin: Survival Cycles

-

Sudden income shock

-

Requires:

-

Ultra-cheap power

-

Frequent hardware upgrades

-

Deep capital reserves

-

Dogecoin: A Price Casino

-

Infinite rewards

-

ROI depends only on:

-

Social hype

-

Price speculation

-

When DOGE falls, miners get crushed.

Ethereum Classic (ETC): Industrial-Grade Design

-

Rewards don’t collapse

-

They decline slowly (~20%)

This allows:

-

Predictable planning

-

Capital budgeting

-

Stable operations

5. ETC vs BTC in 2026

| Metric | Bitcoin | Ethereum Classic |

|---|---|---|

| Reward Change | -50% | -20% |

| Shock Level | Extreme | Moderate |

| Miner Exits | Sudden | Gradual |

| Difficulty Change | Violent | Smooth |

| Cash Flow Stability | Low | High |

➡️ BTC is a gladiator arena.

ETC is a factory.

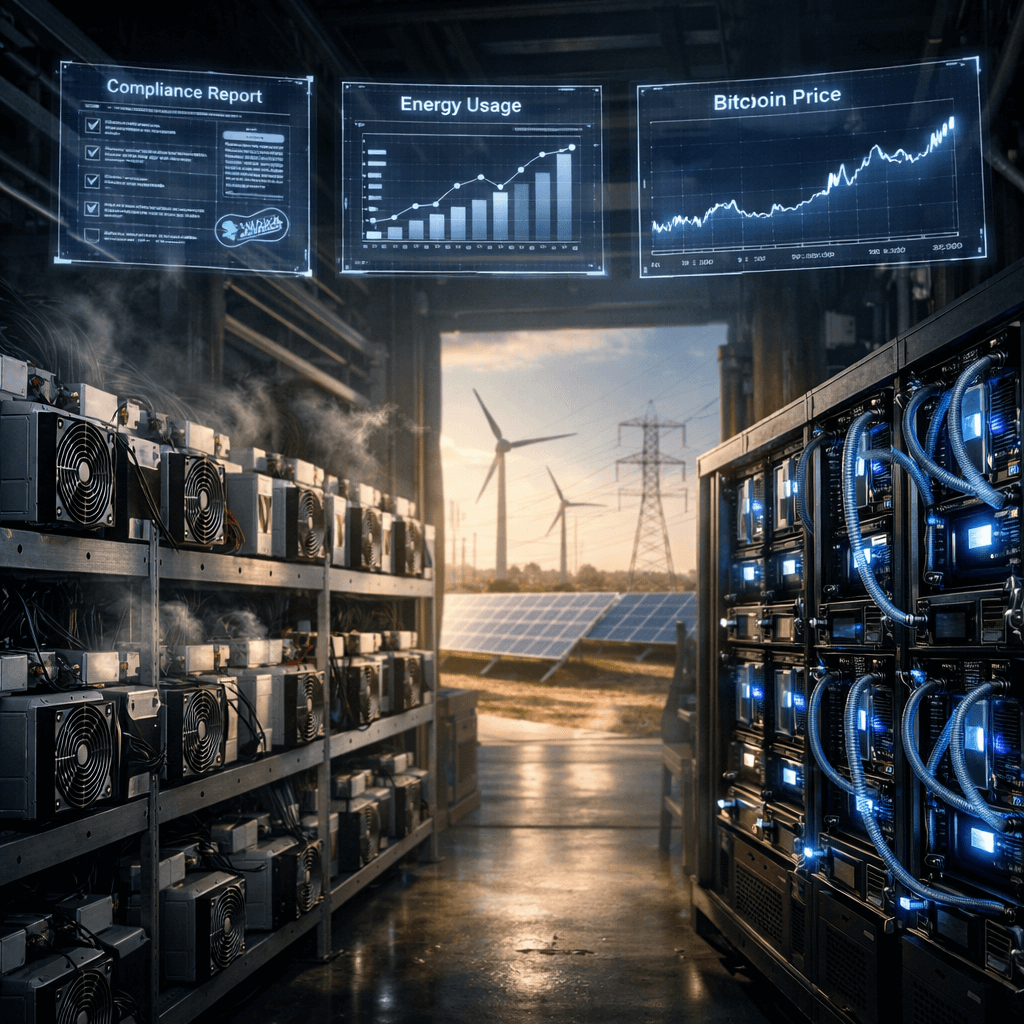

6. Who Survives the Next 20 Years?

Winning Miners:

-

Power below $0.05/kWh

-

Upgrade machines continuously

-

Mine multiple coins

-

Plan by halving cycles, not daily ROI

Losing Miners:

-

High electricity

-

Short-term thinking

-

No difficulty modeling

-

Treat halving as a surprise

Final Truth

Halving is not the end of mining.

It is the filter.

The survivors are not those with the most machines —

but those with the lowest cost, strongest balance sheet, and clearest long-term plan.

In the next decade, mining will stop being a gamble

and become what it was always meant to be:

A capital-intensive, energy-driven, infrastructure business.

Deixar comentário

Este site é protegido por hCaptcha e a Política de privacidade e os Termos de serviço do hCaptcha se aplicam.