Why Compliance, AI Transformation & Energy Integration Will Decide Who Wins

The age of easy crypto mining is officially over.

Once upon a time, all you needed was a few ASIC miners and cheap electricity to print money. In 2026, that era is gone. Mining has entered a new phase defined by regulation, institutional capital, industrial-grade infrastructure, and energy strategy.

For miners, this is not a crypto winter — it is a great filtering event. Small, unstructured operators are being pushed out, while professional, compliant, and capital-efficient miners are positioned to dominate.

Let’s break down the four forces every miner must master in 2026.

1. Compliance Is No Longer Optional

Mining Has Gone Mainstream — and Regulated

Governments have now fully accepted that Bitcoin and digital assets are here to stay. That means licensing, reporting, and taxation are being enforced worldwide.

Key 2026 developments:

-

United States

The Digital Asset Market Clarity Act classifies BTC and ETH as digital commodities, allowing:-

Legal bank custody

-

Institutional financing

-

Clear tax treatment

-

-

Russia & Central Asia

Mining licenses are mandatory. Power usage, equipment and revenue must be registered. -

Europe & Canada

Fossil-fuel mining is restricted, while green energy mining receives tax credits and incentives.

What This Means for Miners

| Miner Type | What You Must Do |

|---|---|

| Mining companies | Register business, file taxes, keep revenue and electricity records |

| Home miners | Control power usage, avoid high-tier electricity pricing, manage noise |

| International miners | Choose legal zones (Texas, Canada, Kazakhstan) and avoid banned countries |

Compliance is no longer a cost — it is a competitive advantage.

2. Texas Mining License: The Global Gold Standard

Texas has become the world’s mining capital thanks to:

-

Electricity as low as $0.02–$0.04/kWh

-

Legal protection for digital asset businesses

-

Grid programs that pay miners to shut down during peak demand

Texas Mining Setup Process (2026)

| Step | What You Do | Timeline |

|---|---|---|

| 1 | Register LLC | 3–5 days |

| 2 | Apply for power grid access (ERCOT) | 2–4 weeks |

| 3 | Environmental & land approval | 4–6 weeks |

| 4 | Mining operation registration | 1–2 weeks |

| 5 | Tax ID and reporting | 3–5 days |

Bonus: Qualified miners receive up to 50% property tax reduction for 3 years and can earn extra income by selling power back to the grid during peak demand.

3. ASIC Efficiency Is Now the Survival Line

In 2026, anything above 10 J/TH is obsolete.

Old miners can no longer survive unless electricity is nearly free.

Top ASICs in 2026

| Model | Hashrate | Power | Efficiency | Price | Payback (4¢/kWh) |

|---|---|---|---|---|---|

| Antminer S21 | 335 TH/s | 2200 W | 6.57 J/TH | $3,200 | 312 days |

| Whatsminer M53S++ | 310 TH/s | 2100 W | 6.77 J/TH | $2,950 | 338 days |

| Sealminer A2 | 226 TH/s | 3729 W | 16.5 J/TH | $1,800 | 404 days |

| Old 2023 models | 110 TH/s | 3200 W | 29 J/TH | $800 | Unprofitable |

Why Old Machines Are Dead

-

60% lower efficiency

-

3× lower profit

-

3× higher failure rate

-

Almost no resale value

Modern miners don’t just earn more — they stay profitable longer.

4. The Rise of AI-Powered Mining Facilities

Mining farms are no longer just for Bitcoin.

As AI explodes, data centers are running out of:

-

Power

-

Land

-

Permits

-

Grid connections

Mining companies already have all four.

By upgrading cooling and networking, miners can:

-

Run GPU AI clusters

-

Lease power and space to AI companies

-

Earn revenue even when Bitcoin difficulty rises

AI hosting allows mining companies to earn during bear markets and halving cycles.

Public mining firms have already raised $4.6 billion to transform their sites into hybrid Bitcoin + AI compute centers.

5. Energy Integration Is the Real Profit Engine

Electricity represents 60–70% of mining costs.

The smartest miners now own their power.

Three Winning Energy Models

-

Build your own solar, wind, or gas plants

→ Stable cost: $0.02–$0.03/kWh -

Use stranded or wasted energy

→ Buy excess wind/solar power at 50% discount -

Move to energy-rich countries

→ Kazakhstan, Turkmenistan, natural gas regions

One public mining company now produces Bitcoin at $18,000 per BTC, far below the global average.

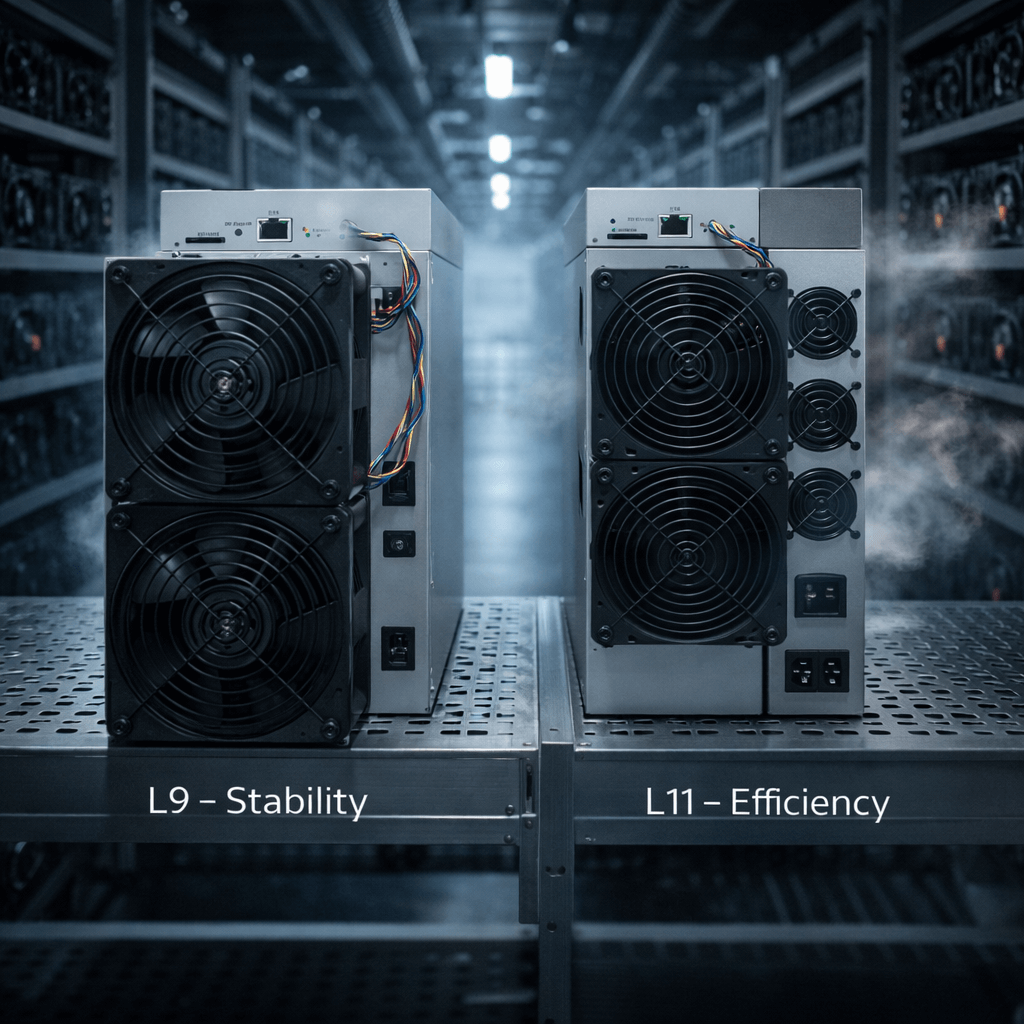

6. Mining Is Now a Financial Asset

Mining in 2026 is no longer “plug in and hope.”

Smart miners use:

-

Hashrate-backed loans

-

BTC futures to lock in profits

-

Bitcoin ETFs to hedge and hold

Monthly Mining Profit Model

| Metric | Example |

|---|---|

| Total hashrate | 10,000 TH/s |

| Power per miner | 2200 W |

| Miners | 30 |

| Daily power use | 1584 kWh |

| Electricity cost | $0.04 |

| Daily power cost | $63.36 |

| BTC price | $97,000 |

| Network hashrate | 78 EH/s |

| BTC mined per day | 0.0577 |

| Daily revenue | $560 |

| Pool fee | $11.2 |

| Daily profit | $485 |

| Monthly profit | $14,563 |

| ROI | 8.2 months |

Final Rule for 2026 Miners

Comply. Upgrade. Control energy. Add AI. Hedge risk.

Bitcoin mining is no longer for hobbyists — it is an industrial, financial, and energy-driven business.

Those who evolve will dominate the next decade.

Those who don’t will disappear.

Hinterlassen Sie einen Kommentar

Diese Website ist durch hCaptcha geschützt und es gelten die allgemeinen Geschäftsbedingungen und Datenschutzbestimmungen von hCaptcha.