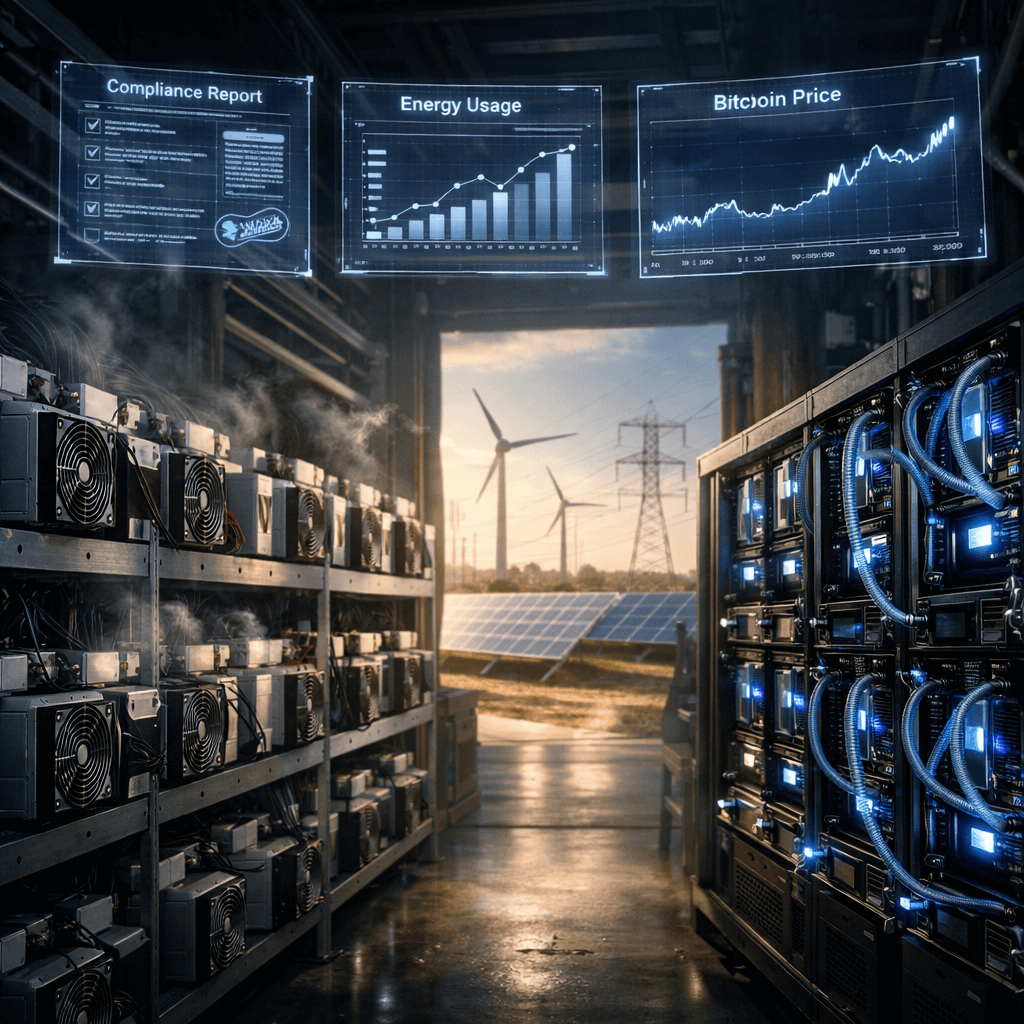

Why Compliance, AI Transformation & Energy Integration Will Decide Who Wins

The age of easy crypto mining is officially over.

Once upon a time, all you needed was a few ASIC miners and cheap electricity to print money. In 2026, that era is gone. Mining has entered a new phase defined by regulation, institutional capital, industrial-grade infrastructure, and energy strategy.

For miners, this is not a crypto winter — it is a great filtering event. Small, unstructured operators are being pushed out, while professional, compliant, and capital-efficient miners are positioned to dominate.

Let’s break down the four forces every miner must master in 2026.

1. Compliance Is No Longer Optional

Mining Has Gone Mainstream — and Regulated

Governments have now fully accepted that Bitcoin and digital assets are here to stay. That means licensing, reporting, and taxation are being enforced worldwide.

Key 2026 developments:

-

United States

The Digital Asset Market Clarity Act classifies BTC and ETH as digital commodities, allowing:-

Legal bank custody

-

Institutional financing

-

Clear tax treatment

-

-

Russia & Central Asia

Mining licenses are mandatory. Power usage, equipment and revenue must be registered. -

Europe & Canada

Fossil-fuel mining is restricted, while green energy mining receives tax credits and incentives.

What This Means for Miners

| Miner Type | What You Must Do |

|---|---|

| Mining companies | Register business, file taxes, keep revenue and electricity records |

| Home miners | Control power usage, avoid high-tier electricity pricing, manage noise |

| International miners | Choose legal zones (Texas, Canada, Kazakhstan) and avoid banned countries |

Compliance is no longer a cost — it is a competitive advantage.

2. Texas Mining License: The Global Gold Standard

Texas has become the world’s mining capital thanks to:

-

Electricity as low as $0.02–$0.04/kWh

-

Legal protection for digital asset businesses

-

Grid programs that pay miners to shut down during peak demand

Texas Mining Setup Process (2026)

| Step | What You Do | Timeline |

|---|---|---|

| 1 | Register LLC | 3–5 days |

| 2 | Apply for power grid access (ERCOT) | 2–4 weeks |

| 3 | Environmental & land approval | 4–6 weeks |

| 4 | Mining operation registration | 1–2 weeks |

| 5 | Tax ID and reporting | 3–5 days |

Bonus: Qualified miners receive up to 50% property tax reduction for 3 years and can earn extra income by selling power back to the grid during peak demand.

3. ASIC Efficiency Is Now the Survival Line

In 2026, anything above 10 J/TH is obsolete.

Old miners can no longer survive unless electricity is nearly free.

Top ASICs in 2026

| Model | Hashrate | Power | Efficiency | Price | Payback (4¢/kWh) |

|---|---|---|---|---|---|

| Antminer S21 | 335 TH/s | 2200 W | 6.57 J/TH | $3,200 | 312 days |

| Whatsminer M53S++ | 310 TH/s | 2100 W | 6.77 J/TH | $2,950 | 338 days |

| Sealminer A2 | 226 TH/s | 3729 W | 16.5 J/TH | $1,800 | 404 days |

| Old 2023 models | 110 TH/s | 3200 W | 29 J/TH | $800 | Unprofitable |

Why Old Machines Are Dead

-

60% lower efficiency

-

3× lower profit

-

3× higher failure rate

-

Almost no resale value

Modern miners don’t just earn more — they stay profitable longer.

4. The Rise of AI-Powered Mining Facilities

Mining farms are no longer just for Bitcoin.

As AI explodes, data centers are running out of:

-

Power

-

Land

-

Permits

-

Grid connections

Mining companies already have all four.

By upgrading cooling and networking, miners can:

-

Run GPU AI clusters

-

Lease power and space to AI companies

-

Earn revenue even when Bitcoin difficulty rises

AI hosting allows mining companies to earn during bear markets and halving cycles.

Public mining firms have already raised $4.6 billion to transform their sites into hybrid Bitcoin + AI compute centers.

5. Energy Integration Is the Real Profit Engine

Electricity represents 60–70% of mining costs.

The smartest miners now own their power.

Three Winning Energy Models

-

Build your own solar, wind, or gas plants

→ Stable cost: $0.02–$0.03/kWh -

Use stranded or wasted energy

→ Buy excess wind/solar power at 50% discount -

Move to energy-rich countries

→ Kazakhstan, Turkmenistan, natural gas regions

One public mining company now produces Bitcoin at $18,000 per BTC, far below the global average.

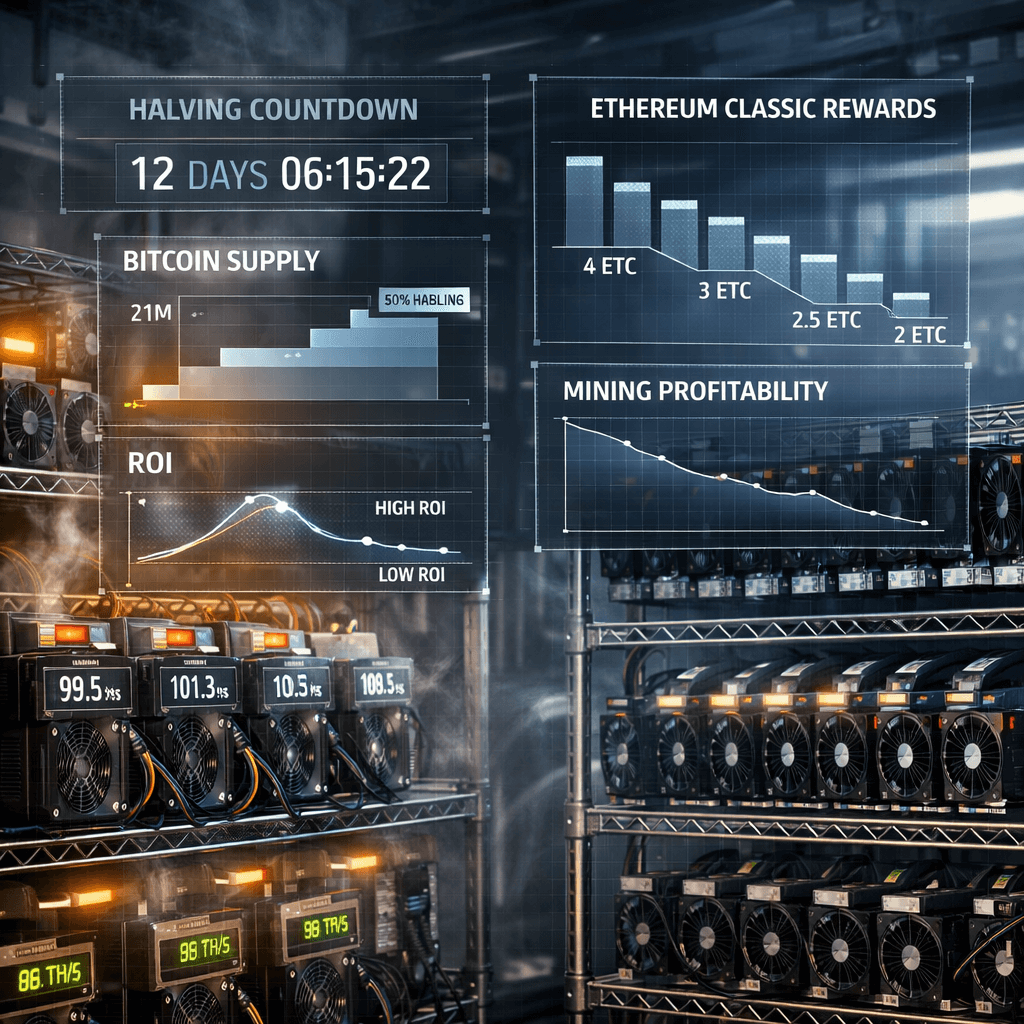

6. Mining Is Now a Financial Asset

Mining in 2026 is no longer “plug in and hope.”

Smart miners use:

-

Hashrate-backed loans

-

BTC futures to lock in profits

-

Bitcoin ETFs to hedge and hold

Monthly Mining Profit Model

| Metric | Example |

|---|---|

| Total hashrate | 10,000 TH/s |

| Power per miner | 2200 W |

| Miners | 30 |

| Daily power use | 1584 kWh |

| Electricity cost | $0.04 |

| Daily power cost | $63.36 |

| BTC price | $97,000 |

| Network hashrate | 78 EH/s |

| BTC mined per day | 0.0577 |

| Daily revenue | $560 |

| Pool fee | $11.2 |

| Daily profit | $485 |

| Monthly profit | $14,563 |

| ROI | 8.2 months |

Final Rule for 2026 Miners

Comply. Upgrade. Control energy. Add AI. Hedge risk.

Bitcoin mining is no longer for hobbyists — it is an industrial, financial, and energy-driven business.

Those who evolve will dominate the next decade.

Those who don’t will disappear.

コメントを残す

このサイトはhCaptchaによって保護されており、hCaptchaプライバシーポリシーおよび利用規約が適用されます。