Technical Principles of Bitcoin

Blockchain Technology

Bitcoin relies on blockchain technology to record and validate all transactions. Blockchain is a decentralized distributed ledger where data is grouped into blocks linked chronologically. Each block contains a cryptographic hash of the previous block, ensuring immutability unless all subsequent blocks are recalculated and consensus is achieved across the network. Global peer-to-peer nodes maintain the blockchain, following a unified consensus protocol to add and validate new blocks.

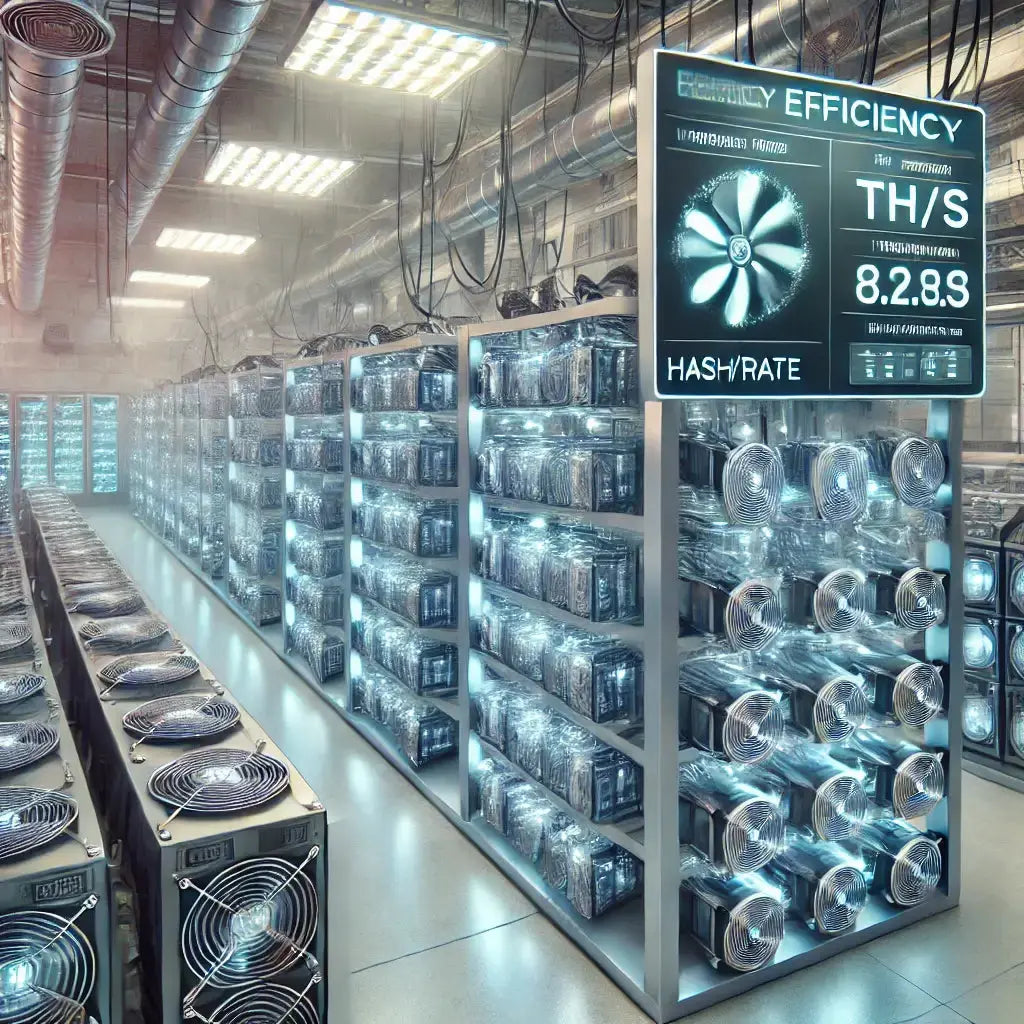

Mining and Proof of Work (PoW)

Bitcoin maintains its blockchain and issues new coins through mining—a Proof-of-Work mechanism. Miners use computational devices to find a nonce that, combined with block data, produces a hash below a target value. Finding this nonce involves extensive trial and error, though verification is simple. Difficulty adjusts every 2016 blocks (roughly every two weeks) to maintain a consistent block generation time of about 10 minutes. Successful miners receive transaction fees and newly minted bitcoins as rewards, currently 6.25 BTC per block (reducing to 3.125 BTC after April 2024). Bitcoin has a fixed supply limit of 21 million, expected to be fully mined by around 2140.

Transaction Validation and Consensus

Bitcoin transactions are validated using cryptographic signatures. Transactions must be signed with the sender’s private key, proving ownership. Network nodes verify these signatures using public keys and ensure sufficient unspent transaction outputs (UTXO). Validated transactions are broadcast and added to blocks by miners. Bitcoin employs the longest-chain rule, trusting the chain with the most accumulated work, resolving temporary forks by extending the longest branch.

Security and Potential Risks

Bitcoin is highly secure due to cryptographic signatures and decentralized node distribution. The network has never been compromised at the blockchain level. However, theoretical risks include a "51% attack," where an entity controlling the majority of network power could rewrite transaction history. User-side security risks (exchanges hacks, private key loss) are also significant. Quantum computing poses a future threat, potentially breaking current cryptographic algorithms, though upgrades to quantum-resistant algorithms could mitigate this.

Investment Value

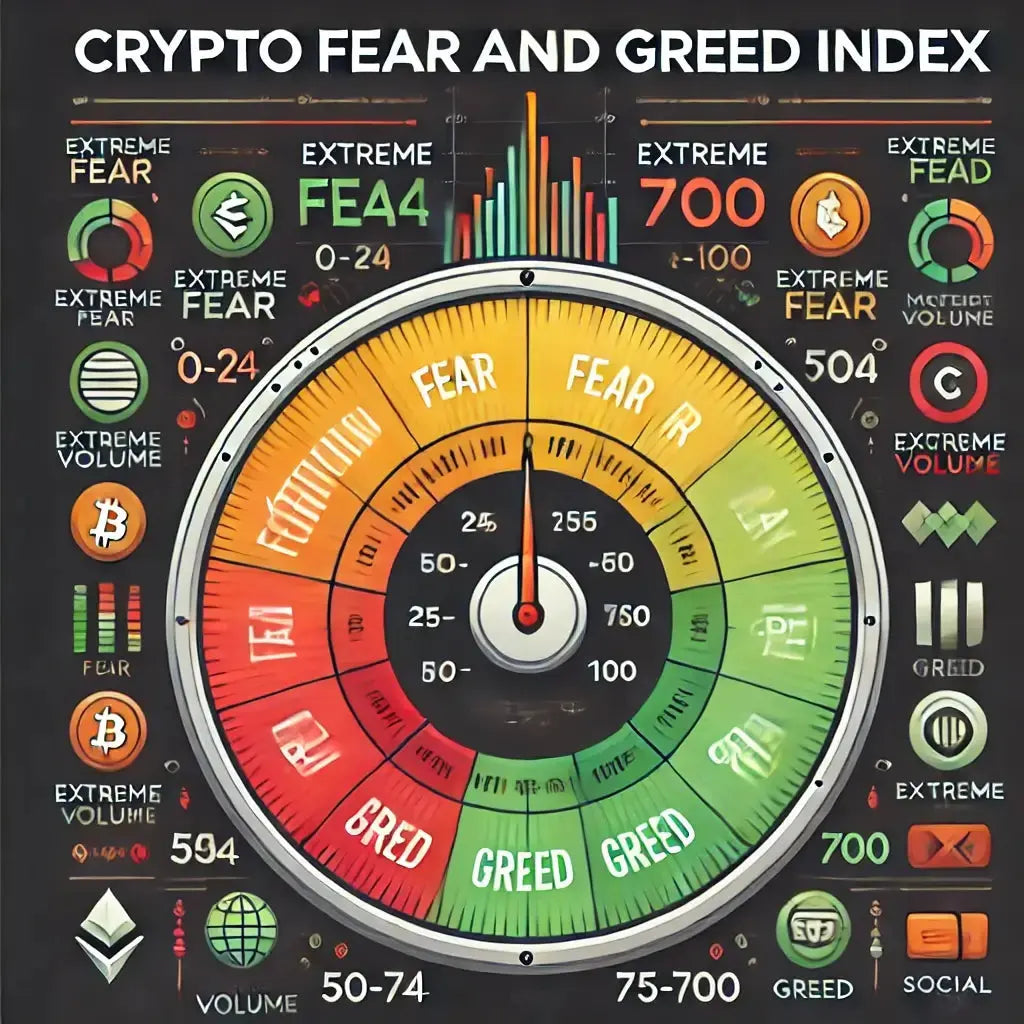

Historical Price Trends and Market Cycles

Bitcoin's price history shows cycles of dramatic bull and bear markets, often linked to "halving" events every four years, where block rewards reduce by half. Prices historically surge post-halving, followed by substantial corrections, though the long-term price trend has risen significantly.

Scarcity and Deflationary Model

Bitcoin's total supply is capped at 21 million, and issuance halves approximately every four years, creating scarcity. Reduced supply growth combined with increasing demand theoretically pushes prices upward. Bitcoin’s digital scarcity parallels gold, appealing to investors seeking inflation protection.

Institutional Investors and Market Factors

Institutional participation, like Tesla’s 2021 Bitcoin purchase and BlackRock’s ETF filings, has elevated Bitcoin's legitimacy and market liquidity. Government policies, macroeconomic trends (interest rates, liquidity conditions), and global regulatory developments strongly influence market dynamics.

Advantages, Disadvantages, and Investment Risks

Bitcoin’s advantages include decentralization, low-cost international transactions, transparency, and potential for innovation. Disadvantages encompass high volatility, scalability limits (approximately 7 transactions per second), environmental concerns (high energy use), regulatory scrutiny, and security vulnerabilities (exchange hacks). Investors must understand these risks, manage capital prudently, and avoid excessive leverage.

Trading Methods

How to Buy Bitcoin

- Cryptocurrency exchanges: Common platforms like Coinbase, Binance, and Kraken facilitate secure buying with fiat currency after identity verification (KYC).

- Peer-to-peer (P2P): Direct trades between individuals using local payment methods. Platforms include Bisq and built-in exchange P2P markets.

- Bitcoin ATMs: Machines allowing cash-to-Bitcoin transactions, convenient but with higher fees.

- OTC and Derivatives: Over-the-counter trades for large amounts, Bitcoin trusts (e.g., GBTC), and ETFs for institutional exposure without direct coin management.

Wallet Types and Storage Security

- Hot wallets: Internet-connected wallets for convenient daily use but susceptible to hacks.

- Cold wallets: Offline wallets like hardware (Ledger, Trezor) or paper wallets provide maximum security. Ideal for storing substantial, long-term holdings.

Selling and Exchanging Bitcoin

- Exchanges: Convenient method for converting Bitcoin into fiat currency.

- P2P selling: Direct transactions with individuals through secure platforms.

- Bitcoin ATMs: Quick cash withdrawal, though with limits and higher fees.

- Wallet/payment services: Services like PayPal or Cash App facilitate easy conversion into account balances or fiat currency.

Bitcoin Use Cases

- Payments: Enables fast, low-cost international transactions. Adoption in retail (Microsoft, Starbucks) and through Lightning Network for micro-payments.

- Investment: Seen as digital gold for value storage, inflation hedging, and portfolio diversification. Investment carries high volatility but significant return potential.

- Smart Contracts and Other Applications: Bitcoin's basic scripting supports limited smart contract functionality (multi-signature, Lightning Network), with innovations like sidechains (Liquid, RSK) expanding capabilities.

- Additional Applications: Remittances, charity donations, DeFi collateral, and influence on CBDC development, traditional financial integration through futures, options, and ETFs.

Overall, Bitcoin offers substantial innovation but requires careful risk management, security measures, and a clear understanding of its underlying technology and market behavior.

References

-

Wikipedia. (n.d.). Bitcoin blockchain links blocks cryptographically to ensure transaction security and immutability. Retrieved from https://en.wikipedia.org/wiki/Bitcoin

-

Wikipedia. (n.d.). Miners compete to record transactions via Proof-of-Work (PoW) by continuously attempting nonces to satisfy difficulty requirements. Retrieved from https://en.wikipedia.org/wiki/Proof_of_work

-

Wikipedia. (n.d.). Bitcoin network mining difficulty adjusts every 2016 blocks to maintain an average block interval of about 10 minutes. Retrieved from https://en.wikipedia.org/wiki/Bitcoin_network#Mining_difficulty

-

Wikipedia. (n.d.). Miners receive Bitcoin rewards for mined blocks; rewards halve every 210,000 blocks, capping total supply at 21 million. Retrieved from https://en.wikipedia.org/wiki/Bitcoin#Supply

-

River Financial. (n.d.). PoW and the longest-chain rule ensure ledger consistency; modifying confirmed transactions is extremely difficult, requiring majority network hash power. Retrieved from https://river.com/learn/what-is-proof-of-work/

-

Wikipedia. (n.d.). Nodes accept the longest chain with the highest accumulated work by default, ensuring consensus across the network. Retrieved from https://en.wikipedia.org/wiki/Blockchain#Consensus

-

Wikipedia. (n.d.). A 51% attack requires control over half the network’s mining power; costs are very high, and successful attacks harm attackers' interests. Historically, only once has a mining pool approached 51%. Retrieved from https://en.wikipedia.org/wiki/51%25_attack

-

Investopedia. (n.d.). Bitcoin’s supply is capped at 21 million; its scarcity positions it as "digital gold" and an inflation hedge, with a halving mechanism continually reducing its supply growth rate. Retrieved from https://www.investopedia.com/bitcoin-halving-4843769

-

Reuters. (2021). Institutional investments by Tesla and others boosted Bitcoin prices; Tesla purchased $1.5 billion in Bitcoin and began accepting it for payments in 2021, significantly driving up prices. Retrieved from https://www.reuters.com/article/us-crypto-currency-tesla-idUSKBN2A81CG

-

Wikipedia. (n.d.). In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, mandating acceptance by all merchants nationwide. Retrieved from https://en.wikipedia.org/wiki/Bitcoin_in_El_Salvador

- Coinbase. (n.d.). Hot wallets are internet-connected and convenient for frequent small transactions but less secure; cold wallets store private keys offline and are safer for holding larger amounts long-term. Retrieved from https://www.coinbase.com/learn/crypto-basics/hot-vs-cold-wallets

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.