Bitcoin (BTC) and the larger crypto market confront a defining moment as the U.S. presidential contest and significant economic events play out this week. From jobless claims to the Federal Reserve's interest rate choices, these elements will have major effects on the path of Bitcoin. Some investors are hoping for a positive conclusion for the crypto market since former President Donald Trump is leading narrowly against Kamala Harris in the polls. Here is a detailed analysis of these future economic factors together with their implications for Bitcoin and the whole crypto scene.

1. The U.S. Presidential Election 2024: Lead of Trump and Bitcoin Attitude

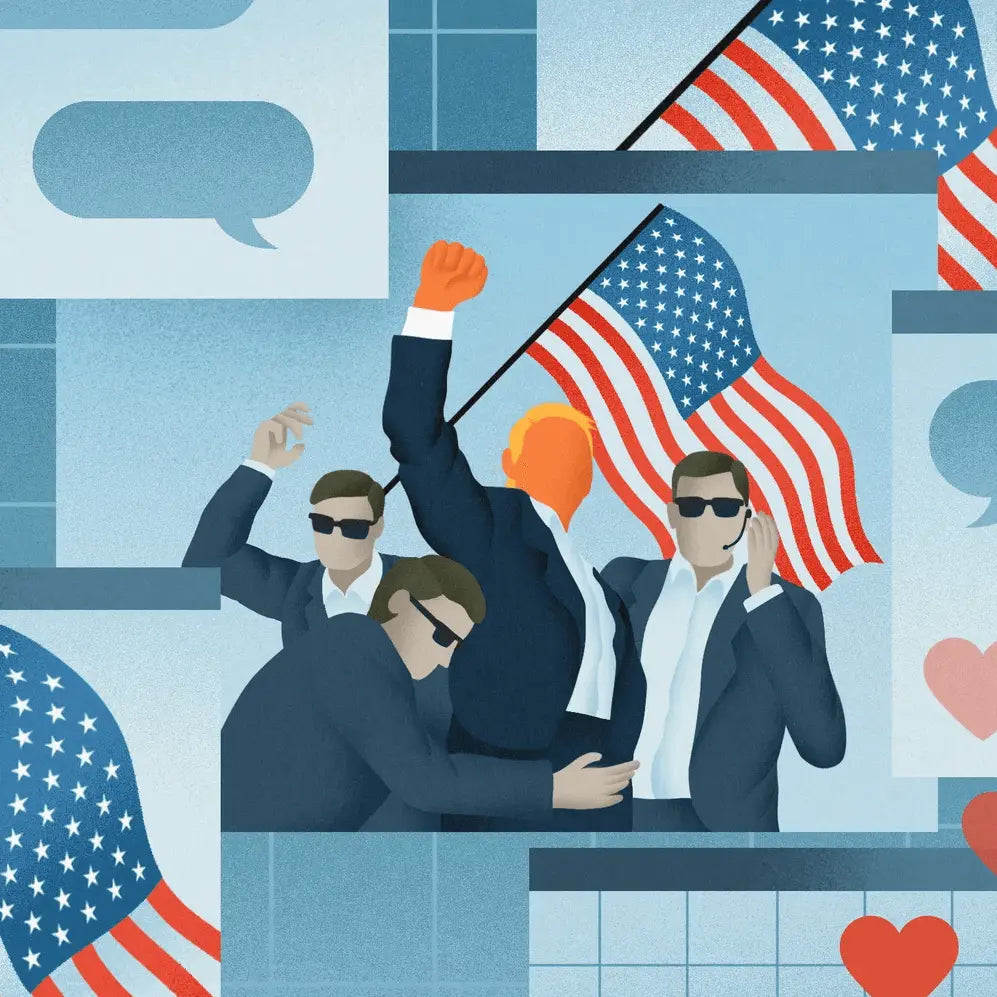

One of the most watched worldwide events, the 2024 U.S. election has possible consequences for cryptocurrencies among other financial markets. With Trump slightly ahead in important polls, the contest between Republican nominee Donald Trump and Democratic Vice President Kamala Harris has become less competitive. Platforms like Polymarket and Kalshi show Trump leading by roughly 52% against Harris's 48%, therefore indicating significant conservative support even in the context of a volatile economic background.

Especially for cryptocurrency investors, a Trump victory might inspire market optimism. Often supporting a more relaxed regulatory stance, Trump's policy agenda might indicate a friendlier climate for cryptocurrencies and other financial instruments. Unlike Harris, who advocates careful control on cryptocurrencies, Trump's policies could build a favorable regulatory environment allowing more innovation and acceptance in the crypto industry.

From a Bitcoin standpoint, pro-Trump attitude could comfort those worried about tight policies. Many hope for a favorable environment for economic freedom—including the right to invest in alternative assets like Bitcoin—with Trump in power. Political stability under Trump might translate into market stability, which historically usually benefits greater Bitcoin prices. As election results arrive, traders and investors should pay great attention since they will determine the direction of Bitcoin's performance in the next weeks.

2. Labor Market and Economic Sentiment: Initial Jobless Claims

Another key event is the first jobless claims report due on Thursday, November 7, following the election. An indication of the state of the labor market, jobless claims reflect if more Americans are seeking unemployment benefits—a symptom of possible economic stress. Claims last week totaled 216,000, somewhat less than in October at 228,000. Analyzers predict a climb to over 220,000 this week.

An increase in jobless claims could indicate a recession, which usually causes caution in conventional markets. For those who invest in cryptocurrencies, though, indications of economic downturn can have two-edged effects. A lessening job market could cause some investors to turn to Bitcoin as a counter to economic uncertainty. Observed in earlier economic downturns, this trend reflects a larger opinion that Bitcoin is a "safe-haven" asset, like digital gold.

Moreover, a softer employment market under Trump's direction could force his government to implement economic support policies increasing consumer spending, therefore indirectly benefiting Bitcoin. Under a Trump presidency, policies meant to revive the employment market or boost economic growth could inspire good feeling since investors expect fresh economic resilience and a strong financial climate for Bitcoin.

3. Meeting of the Federal Open Market Committee (FOMC), Rates Cuts and Bitcoin Prospects

Thursday also marks the FOMC meeting of the Federal Reserve, which will produce minutes and analysis on upcoming rate reductions. With CPI (Consumer Price Index) hanging about 2.4%, the Fed's current goal inflation rate of 2% almost seems reached. Based on speculations among economists, the Fed may declare more rate cuts—a decision that would have a big effect on Bitcoin.

Lower interest rates historically have been favorable for Bitcoin since they lower the opportunity cost of keeping alternative assets like cryptocurrency instead of cash. Should the Fed proceed with a rate reduction, it might give the price of Bitcoin much-needed impetus. With the CME Fed Watchtool showing a 99.9% chance of a 25-basis-point cut, market expectation of the move already shows great conviction.

Given Trump's past support of low-interest-rate policies to boost economic growth, there is more chance of continuous rate decreases under his presidency. Appealing to investors looking for assets that profit from inflation and economic growth, a Trump government's advocacy of favorable fiscal policies might help to confirm Bitcoin's increasing trend.

The 2024 Outlook of Bitcoin: A Potential Rally Following Election

Although the events this week bring volatility, overall the picture of Bitcoin is still bright independent of the outcome of the election. Targeting a BTC price of $100,000 by the end of 2024, analysts from Spotonchain believe that the expansion trajectory of Bitcoin is probably going to continue independent of the result of the election. Spotonchain claims, "The true bull run begins post-election,” with a possible surge in store after political uncertainty passes.

But given that a Trump victory marks a return to pro-market policies that give economic growth and low regulation top priority, I believe a Trump victory could be especially good for Bitcoin. Trump's possible influence on economic policy might create a better climate for Bitcoin, therefore shifting capital from conventional assets into the crypto field. Furthermore, a Trump-led government might remove several legal obstacles that have slowed down the expansion of Bitcoin, therefore allowing a more direct road for general acceptance.

My View of Trump's Affect on Bitcoin and Crypto Markets

Having seen the benefits of pro-growth policies, I think Trump's possible comeback to power could have a favorable impact on the direction of Bitcoin. Trump's agenda fits a lowered regulatory posture, which might create conditions where cryptocurrencies such Bitcoin might flourish. Furthermore, Trump's economic policies might guide investors toward alternative assets, particularly in cases of uncertainty related to inflation or recession in conventional markets.

On the other hand, a Harris government might intensify investigation of the crypto market. Her emphasis on tougher rules could discourage possible investors, therefore complicating the atmosphere in which Bitcoin can flourish. For this reason, pro-Trump investors in the crypto world could view a Trump win as a pivotal determinant of Bitcoin's momentum into 2025.

In essence, the future of Bitcoin depends on election and economic data.

For Bitcoin and the larger crypto market, this week is really crucial. With the U.S. election, jobless claims, and FOMC meeting all ready to play, Bitcoin's price is probably going to fluctuate greatly. For those who advocate pro-market policies and view Bitcoin as a main alternative asset in a Trump administration, Trump's narrow lead gives hope.

The FOMC rate decision and unemployment claims figures highlight even more the possibility of Bitcoin to surge in reaction to economic difficulties. For both supporters of Bitcoin and pro-Trump policies, this week marks a pivotal point where political and financial forces come together maybe opening the path for the ongoing rise of Bitcoin.

The way these events turn out going ahead will probably determine Bitcoin's fate. With Trump leading in the polls, there is an optimistic indication for a favorable economic climate that would let Bitcoin keep marching toward $100,000. Although hazards still exist, the economic posture of a Trump government could provide a rich foundation for expansion of Bitcoin and other cryptocurrencies in 2024 and beyond.

Editor's Choice

Goldshell AE BOX II (54Mh/s) ALEO Miner

Sale price$120.00 USD

Goldshell BYTE

Sale priceFrom $59.00 USD

Goldshell E-AE1M (230Mh/s) Aleo Miner

Sale price$600.00 USD

IceRiver AE0 (60Mh/s) ALEO Miner

Sale price$290.00 USD

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.