As Bitcoin's (BTC) recent comeback approaches its former all-time high, investors' hope is being sparked once more. With BTC prices currently close to $70,000, on-chain data indicates that the coin's positive momentum could soon propel it further higher, so perhaps reaching a new objective of $78,000. As the digital asset keeps gaining momentum, this surge has positioned 95% of Bitcoin holders in a profitable situation, a major turning point. Still, what is causing this spike and how sustainable is it?

Examining the current rally in Bitcoin: momentum and profitability

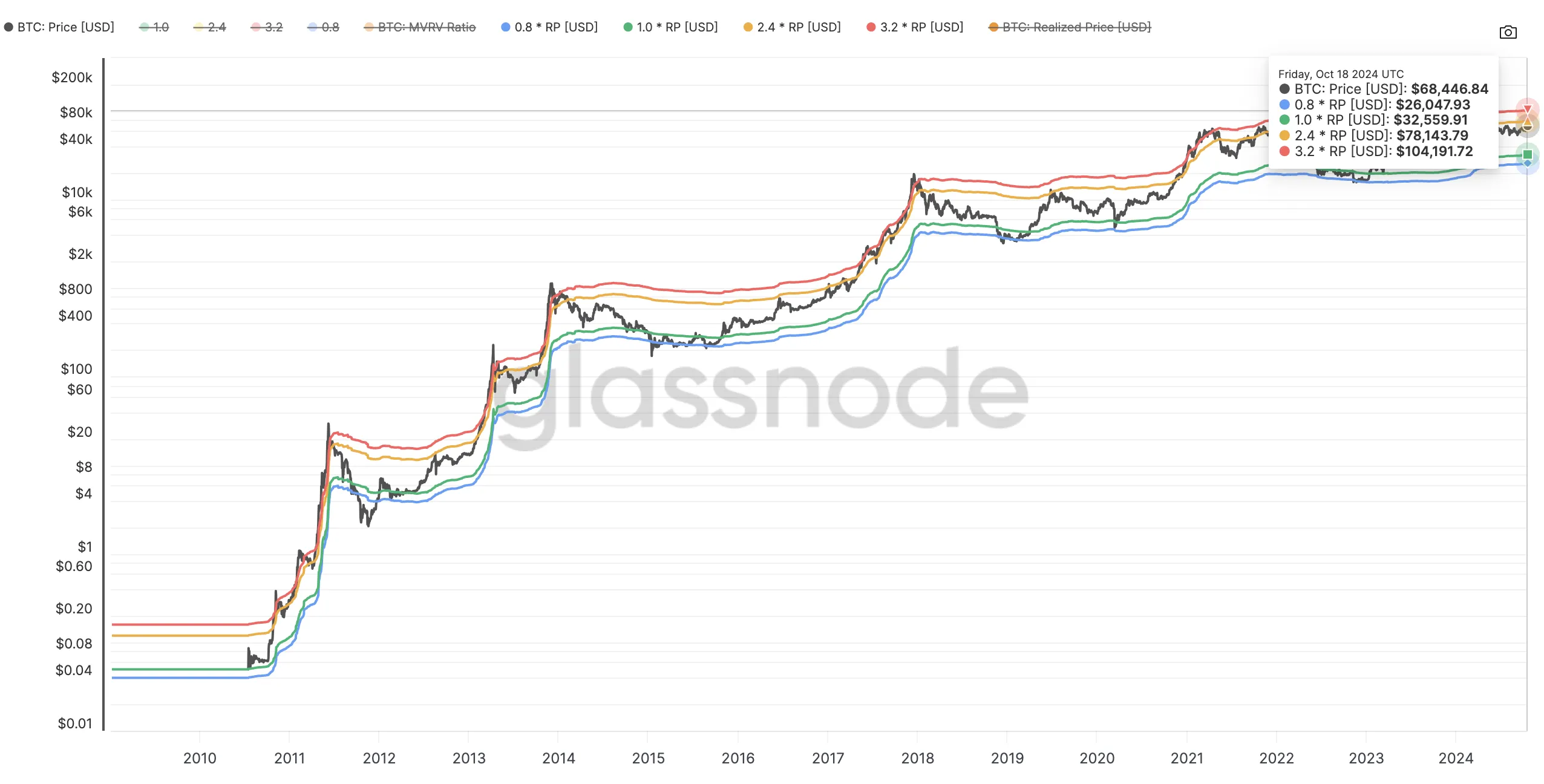

Bitcoin's price has jumped 10% over the last seven days, revitalizing the cryptocurrency market. Data from Glassnode indicates that the coin is currently trading above the declining channel it had been caught in for several months, suggesting great potential for additional price rises.

Tracking the average price at which coins were bought, Bitcoin's Global In/Out of Money (GIOM) model indicates that BTC is in a solid position to achieve more gains. Given the great majority of investors are in profit right now, Bitcoin could eventually surpass the $70,000 mark and land at $78,000.

However, why is this occurring? Technical indicators and market psychology together hold the key.

The Uptober of Bitcoin: a Powerful Comeback

Originally questioned as BTC dropped from $63,000 to below $59,000 in early October, October—often referred to as "Uptober" by the crypto community—first caused uncertainty because of its usually optimistic price activity. This decline raised questions about whether the typically positive momentum of the month might not show itself this year. But by mid-October, Bitcoin started to recover, and the upward trend has since quickened to indicate that the positive attitude is once more on line.

Mostly, this turnaround can be ascribed to growing investor confidence. With only 994,101 addresses—holding roughly 630,000 BTC—BTC holders are disproportionately in profit, according to GIOM data, with unrealized losses. This is a far smaller share of the market than those in profit, which adds even more to the positive attitude.

On-Chain Indicators: Their Significance

Understanding the importance of on-chain indicators like the GIOM and Market Value to Realized Value (MVRV) pricing ranges is crucial for those closely tracking the price swings of Bitcoin. By comparing the price at which users bought their BTC against its current market value, these tools enable one to evaluate the degree of support and resistance.

With BTC approaching a weak supply wall at $72,500, the GIOM statistics show. This implies that most Bitcoin owners have already locked gains at lower levels, therefore lowering the possibility of notable selling pressure at this price range. The market has essentially laid a firm basis that would help to support more increases.

Likewise, the MVRV pricing ranges imply that the present price of Bitcoin can rise considerably more and have a possible peak of $78,143. This would show a 14.25% rise from its present position, thereby supporting the theory that the bullish trend of BTC is still intact.

Why Bitcoin Is Set Up for Additional Profit

From a more general standpoint, the present surge in Bitcoin is a reflection of the changing market dynamics that still support the top cryptocurrency in the world—not only a technological phenomena. Bitcoin has always flourished in unpredictable economic times; many investors are looking to BTC as a hedge against inflation and devaluation of currencies given continuous change in the worldwide market.

Further adding to Bitcoin's appeal as a store of value is its capacity to regularly place a sizable fraction of its holders in profit. Historically, when Bitcoin moves into a phase whereby most addresses are lucrative, it usually fuels even more optimistic attitude. This confirms the long-term viability of Bitcoin, which attracts demand and raises prices by investors.

At ZhenChainMicro, we have long thought that Bitcoin can withstand market fluctuations and come out stronger every rally. Another illustration of how Bitcoin keeps surprising expectations is what is happening right now as its distributed and strong character makes it a special asset class in the financial scene. The fact that BTC is almost completely profitable for its owners is evidence of the faith investors have in its long-term worth proposition.

Technical Aspects Encouraging the Bullish Trend

Technically, Bitcoin's departure from the declining pattern it had been trading in since March is obviously positive. Comparatively to historical and recent market fluctuations, the Awesome Oscillator (AO)—a tool—has displayed progressively favorable values. This suggests increasing momentum and implies that the bulls are definitely under control.

Should Bitcoin keep up its momentum, the $78,000 target appears really reasonable. Traders should still be wary of any short-term corrections nonetheless. Should selling pressure develop, BTC might pull back to roughly $62,555 before trying once more a rally.

Notwithstanding these possible setbacks, the general trend is still positive and the long-term view shows rising prices.

Ahead: The Evolution of Bitcoin

All eyes are on the $70,000 mark and above as Bitcoin keeps on its increasing path. Breaking beyond this psychological barrier could indicate to many investors the beginning of yet another significant bull run. Strong on-chain support, rising institutional interest, and good macroeconomic conditions help Bitcoin to keep on its climb.

Investors should be aware, nevertheless, that the crypto market is always naturally volatile. Although the long-term picture is bright, short-term swings are probably inevitable as the market absorbs the fast price rise of Bitcoin.

For those involved in cryptocurrencies, this is still another proof of Bitcoin's fortitude. Since Bitcoin leads the market, its performance usually shapes the direction of the wider crypto market. Should BTC keep riding on this trend, it might open the path for more rises across other main cryptocurrencies.

At ZhenChainMicro, we remain hopeful about Bitcoin's long-term possibilities and are eager to observe how this rise turns out. Whether your interests are in blockchain technology, trading, or investing, it is abundantly evident that Bitcoin's place in the world financial system is only growing more important year by year.

Final Notes

The present price explosion of Bitcoin goes beyond a transient increase. It is a mirror of the growing significance of cryptocurrencies in the worldwide financial system. Bitcoin is ready to create history once more by reaching a new all-time high; on-chain data supporting additional price gains and the bulk of holders already in profit points to it.

Now is a crucial time for investors to remain informed and keep constant market observation. Although BTC is looking around $78,000, there is great possibility for ongoing increases; yet, as always, care is urged in such a volatile market.

Bitcoin is the pillar of this new financial era—one driven by decentralization, innovation, and a rising need for alternatives to conventional financial systems—even as the bitcoin environment changes.

Disclaimer:

ZhenChainMicro is an official partner of Goldshell. We are engaged in the sale of cryptocurrency mining equipment and miners. While we may accept cryptocurrency as payment, we do not hold or store any substantial amount of cryptocurrency beyond what is necessary for operational purposes. Our business is strictly focused on providing cryptocurrency mining hardware, and we do not offer any financial services or investment products related to cryptocurrency. All transactions are for the purchase of mining equipment only.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.