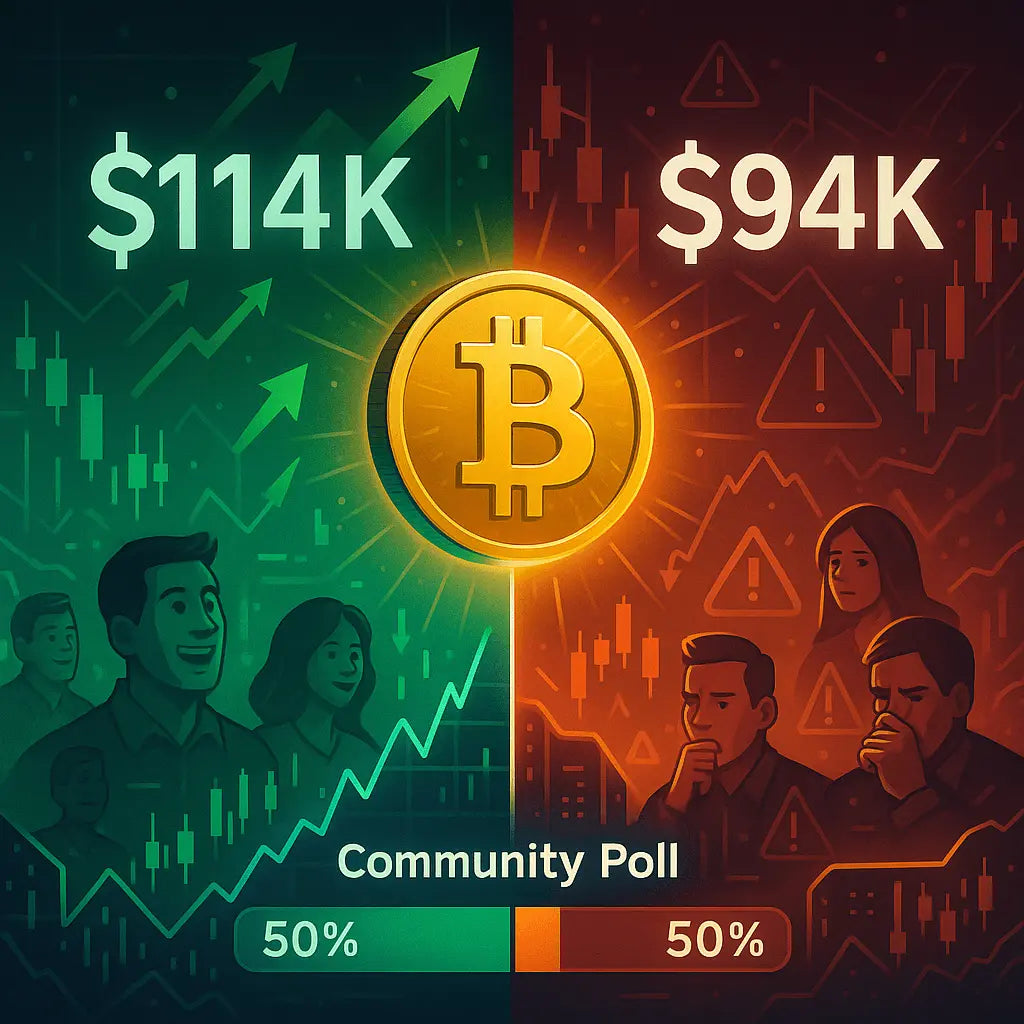

As Bitcoin hovers in a tight range, a recent community poll conducted by analyst Matthew Hyland revealed an almost perfectly split sentiment: will Bitcoin rally to a new high or face a steep retracement? The results highlight growing uncertainty—and opportunity—in the crypto market.

The Poll That Sparked Debate

Crypto analyst Matthew Hyland recently ran a poll on X (formerly Twitter) asking a deceptively simple question:

“Will Bitcoin go to $114,000 next or drop to $94,000?”

Surprisingly, the outcome was nearly a dead heat:

-

50.2% voted for a drop to $94,000

-

49.8% expect a rise to $114,000

While just a community poll of ~1,300 participants, the result underscores a deeply divided market—one where neither bulls nor bears hold clear control. It’s a sign of both caution and anticipation in what has become one of the most closely watched phases of this cycle.

Where Bitcoin Stands Now

At the time of the poll, BTC was trading around $104,500, sitting right between the two proposed targets. The numbers paint the picture:

-

A drop to $94,000 would represent a ~10% correction.

-

A move up to $114,000 would be a ~9% gain and a breakout above May’s all-time high of $111,900.

For over a month now, Bitcoin has been stuck in a tight range, drifting sideways with low volatility. According to CoinMarketCap data, BTC has declined just 2.1% in the past 30 days. The market appears to be consolidating—but for what?

Why Bears Expect a Pullback to $94K

Despite overall bullish sentiment in the crypto space, several key factors support the bear case:

-

Overextended RSI on Higher Timeframes

Technical indicators suggest that BTC has been overbought, particularly after the post-halving rally. A cooldown may be necessary to reset momentum. -

Macroeconomic Headwinds

The Fed remains hawkish, with interest rates high and inflation still sticky. Tighter monetary policy limits the upside for risk assets, including crypto. -

ETF Momentum Slowing

While spot Bitcoin ETFs have been a major driver of inflows, the pace has decelerated. Recent daily net inflows are smaller than the surges seen in March and April.

Why Bulls Are Calling for $114K and Beyond

On the flip side, strong arguments exist for the upside:

-

Robust ETF Inflows

U.S. spot Bitcoin ETFs saw 8 consecutive days of net inflows as of June 18, with BlackRock’s IBIT and Fidelity’s FBTC leading the charge. The June 18 inflow alone topped $388 million. -

Post-Halving Bull Cycle Still Unfolding

Historically, Bitcoin experiences exponential growth in the 12–18 months following a halving. If history rhymes, this rally may be just getting started. -

Institutional Adoption on the Rise

Institutions continue to gain BTC exposure through ETFs, funds, and treasury allocations, fueling long-term demand and reducing circulating supply.

Key Technical Levels: A Market on Edge

The community poll results illustrate a key fact: we are at a price pivot point. A breakout in either direction could trigger a strong follow-through move.

-

$94,000 acts as a major psychological and technical support.

-

$114,000 represents a breakout target above the previous ATH.

-

A confirmed break of $114K could open the door to $130K–$135K, with some analysts projecting even more aggressive targets by Q4 2025.

Neutral Sentiment = Tension Builds

The widely followed Crypto Fear & Greed Index currently sits at 54, firmly in the "Neutral" zone. This represents a cooling of sentiment from previous months when the index often hovered in the “Extreme Greed” territory.

This emotional neutrality suggests indecision, not disinterest.

Meanwhile, related equities are showing weakness:

-

MicroStrategy (MSTR) stock, a leveraged play on Bitcoin, has dropped over 10% in the past 30 days.

-

The S&P 500 has also flattened, reflecting broader market fatigue.

Expert Opinions Are All Over the Place

Crypto thought leaders are not in agreement either, which reflects the fragmented nature of the current market narrative:

Bullish Voices

-

Michael Saylor (MicroStrategy): Unwavering in his Bitcoin evangelism, Saylor believes “there is no top” to BTC—only time.

-

Arthur Hayes (BitMEX founder): Predicts Bitcoin will hit $250,000 by year-end and calls for a parabolic rally driven by geopolitical chaos and fiat devaluation.

Bearish or Cautiously Optimistic

-

Rekt Capital: Warns that historical Bitcoin bull runs often include a mid-cycle correction before parabolic moves.

-

CryptoQuant & Glassnode analysts: Indicate that on-chain activity has cooled, suggesting that demand may need to recharge before the next leg up.

3 Potential Scenarios and How to Prepare for Each

1. Pullback to $94,000

-

Risk: If $94K fails to hold, panic selling could accelerate.

-

Strategy: Conservative investors may wait for a bounce confirmation or place staggered buy orders between $90K–$95K.

2. Breakout to $114,000–$130,000

-

Trigger: ETF inflows re-accelerate + macro sentiment improves.

-

Strategy: Trend-following traders could set breakout buys with clear stop-losses. Partial profit-taking above ATH can help reduce risk.

3. Moonshot to $200,000+

-

Conditions: Requires a strong global risk-on environment, dovish Fed, and Bitcoin dominance in the narrative.

-

Strategy: Suitable only for long-term holders with high risk tolerance. Allocate in tranches and be prepared for volatility.

Final Thoughts: Opportunity Lies in Uncertainty

Matthew Hyland’s poll has done more than reveal a split vote—it has mirrored the exact psychological crossroads where Bitcoin now stands.

Are we consolidating before a breakout? Or topping out before a correction?

No one knows for sure, and that’s exactly why the best investors plan for multiple scenarios. Whether you're a cautious trader, a seasoned HODLer, or a long-term allocator, now is the time to:

-

Stick to your risk management rules,

-

Set alerts on key price levels,

-

Keep emotions in check, and

-

Avoid blind conviction in either direction.

Bitcoin’s next major move may not be far off—and when it comes, it could be fast and decisive.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.